Investing

Flint Atlantic is an impact-first investment firm. We look for innovative solutions to improving the access to and quality of healthcare services in Africa that also have the potential for financial returns

We invest through equity, quasi-equity and convertible debt instruments in companies across the entire healthcare value chain. Our portfolio comprises of opportunities that yield a pre-determined risk-adjusted financial return but also create demonstrable social impact.

We add value beyond financing,leveraging our in-house experience and strategic relationship to provide advisory services across all stages of the value chain in the healthcare industry in Africa.

Investment Criteria

We have 5 key investment criteria:

Geographic Focus

We actively seek investment opportunities in East and West Africa.

Stage

We invest in SMEs that have demonstrated viability and have significant growth potential.

Investment Size

We typically provide investment capital between $500k and $5m.

Management Team

We seek companies backed by a strong management team with a track record of superior performance and ability to execute their vision.

Social Impact

Our preferred investee companies are focused on improving the access to and quality of healthcare services, particularly for underserved populations.

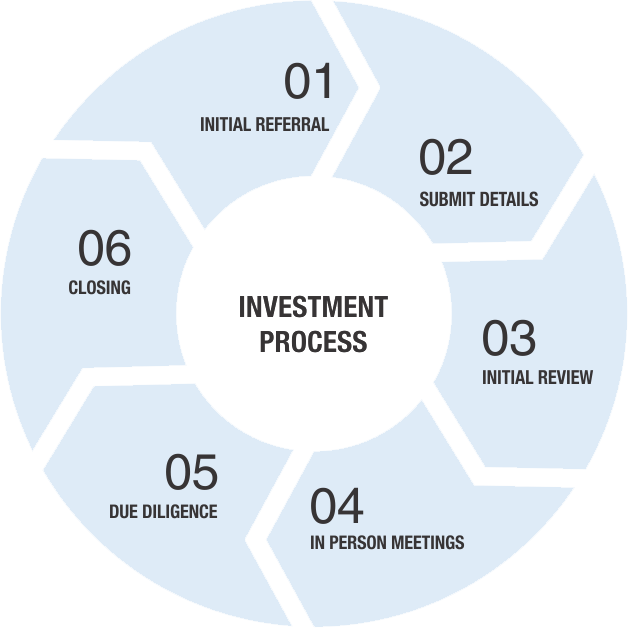

Investment Process

Our investment process follows 6 major steps:

- Initial Referral

The best way to reach out to us is through a mutual connection who will provide an introduction backed up by a strong recommendation. We also accept inbound applications through our web form available here

- Submit details

After the initial referral or web based application, we will contact you to send us an investor deck (10-15 slides) summarizing the opportunity including the following details: product/service description, market potential, team, ecosystem/competition, social impact, fundraising specifics, and other salient details. Be sure to include evidence that your product/service meets our investment criteria. If you have a prototype, send us access to test it out, or include links to a video where the function is clearly demonstrated. - Initial Review

We will review your materials to establish if the opportunity meets our core criteria: sector, geography, stage, size of the investment, management team and social impact potential. We then assess if there is any risk of competition or overlap with the rest of our involvements. Given our active investment model with our companies – most of which are at the early stage, we mitigate the risks of conflict of interests at the time of the investment. If we determine that the opportunity is not a fit for us, we aim to let you know within a few weeks. If further information is required at this stage (eg. Financial models or statements), we contact you to provide those before we move on to the next stages. - In person meetings

If we are interested in learning more, we invite you to visit us in one of our offices (Lagos or Abuja). We prefer first meetings in person, but are able to make exceptions for non-local teams. We can also arrange skype calls where in person meetings are logistically very difficult. Typically, you can expect to have the initial meeting with one member of our team. - Due Diligence

If the meetings are successful, we will begin the due diligence process which starts with meeting the other team members, other contacts with experts in our network, reference checks, etc. In this phase, opportunities are vetted by senior deal team members and an Investment Memorandum is prepared. Investment opportunities are then presented to the Investment Committee, which is responsible for reviewing and analysing the findings from the due diligence process and making the ultimate decision on whether or not the firm invests.One of the goals of our diligence cycle is spending time together to ensure a good fit between the target company and our firm–Our investments are typically long term and companies may spend 5 to 7 years in the portfolio, so a great personal relationship is very important.We encourage you to go though the same level of due diligence on us. We are happy to answer any questions you have about us at this stage.

- Closing

If everything checks out for both sides, we’ll start discussing terms. If we are leading the investment (as is typical for most of our target companies), we will make an offer via a termsheet.

If the discussions and negotiations are acceptable to both sides, we will commit and invest once the legal documents have been signed.

2

Submit details

After the initial referral or web based application, we will contact you to send us an investor deck (10-15 slides) summarizing the opportunity including the following details: product/service description, market potential, team, ecosystem/competition, social impact, fundraising specifics, and other salient details. Be sure to include evidence that your product/service meets our investment criteria. If you have a prototype, send us access to test it out, or include links to a video where the function is clearly demonstrated.

3

Initial Review

We will review your materials to establish if the opportunity meets our core criteria: sector, geography, stage, size of the investment, management team and social impact potential. We then assess if there is any risk of competition or overlap with the rest of our involvements. Given our active investment model with our companies – most of which are at the early stage, we mitigate the risks of conflict of interests at the time of the investment. If we determine that the opportunity is not a fit for us, we aim to let you know within a few weeks. If further information is required at this stage (eg. Financial models or statements), we contact you to provide those before we move on to the next stages.

4

In person meetings

If we are interested in learning more, we invite you to visit us in one of our offices (Lagos or Abuja). We prefer first meetings in person, but are able to make exceptions for non-local teams. We can also arrange skype calls where in person meetings are logistically very difficult. Typically, you can expect to have the initial meeting with one member of our team.

5

Due Diligence

If the meetings are successful, we will begin the due diligence process which starts with meeting the other team members, other contacts with experts in our network, reference checks, etc. In this phase, opportunities are vetted by senior deal team members and an Investment Memorandum is prepared. Investment opportunities are then presented to the Investment Committee, which is responsible for reviewing and analysing the findings from the due diligence process and making the ultimate decision on whether or not the firm invests.

One of the goals of our diligence cycle is spending time together to ensure a good fit between the target company and our firm–Our investments are typically long term and companies may spend 5 to 7 years in the portfolio, so a great personal relationship is very important.

We encourage you to go though the same level of due diligence on us. We are happy to answer any questions you have about us at this stage.

6

Closing

If everything checks out for both sides, we’ll start discussing terms. If we are leading the investment (as is typical for most of our target companies), we will make an offer via a termsheet.

If the discussions and negotiations are acceptable to both sides, we will commit and invest once the legal documents have been signed.

Culture and Values

Our firm is guided by a number of core values that form our culture and shape the way we do business.

Integrity

Conducting ourselves with integrity is a fundamental principle that guides everything we do. Honesty and a strong sense of morality are key character traits that help to foster both personal and professional relationships and maintain a good reputation.

Teamwork

We are united by a shared vision and the determination to achieve it. We place great importance on collaboration and drawing on diverse experiences to create solutions.

Accountability

As individuals and as a firm we hold ourselves accountable to our commitments, promises, decisions, failures and successes.

Creativity

We implement an innovative approach to sourcing, structuring and creating value for our investment opportunities and value the ability to challenge established practices.

Thought-Leadership

We pride ourselves on excellence in everything we do, and harness our collective expertise and experience to forecast trends before they occur and shape the markets in which we invest.